The Workforce Inflection Point: Acute Care’s Path to Resilience

- Greg Paulus

- Sep 18, 2025

- 8 min read

The acute care nursing landscape stands at a critical transformation point, where traditional staffing models face unprecedented pressure from persistent shortages, escalating costs, and evolving workforce expectations [1][2]. Healthcare organizations are increasingly recognizing that reactive hiring strategies, built around expensive agency relationships, are unsustainable, driving a fundamental shift toward a strategic workforce architecture that balances permanent stability with flexible capacity [3][4]. This transformation represents more than operational optimization—it constitutes a reimagining of how acute care facilities build resilient, cost-effective nursing teams capable of delivering consistent patient outcomes while adapting to market volatility [5][6].

The convergence of a projected nursing shortage exceeding 500,000 registered nurses, rising labor costs that have increased 37% since the pandemic, and accelerating adoption of technology-enabled staffing platforms creates an unprecedented opportunity for healthcare systems to redesign their workforce strategies [1][2][7]. Organizations that embrace strategic workforce planning over reactive crisis management will establish sustainable competitive advantages in cost efficiency, quality outcomes, and operational resilience [8][6].

Current Market Dynamics and Industry Transformation

The Healthcare Staffing Crisis Intensifies

The healthcare workforce shortage has reached critical mass, with more than 193,000 registered nurse openings projected annually through 2032 due to workforce turnover and increasing demand for healthcare services in aging populations [2][9]. The nursing shortage specifically affects nearly every healthcare organization, with more than 138,000 nurses having left the workforce since 2022. Additionally, 39.9% of registered nurses report an intent to leave within the next five years [3][4].

This shortage is compounded by demographic trends, with nearly 50% of nurses over age 50 approaching retirement, creating a dual challenge of immediate staffing needs and looming workforce replacement requirements [1][2]. The financial impact of nursing turnover has reached staggering proportions, with the average cost of replacing a single registered nurse increasing by 8.6% to $61,110 in 2025 [10][11].

Technology-Driven Market Evolution

Healthcare staffing is undergoing rapid digitization, with 94% of healthcare companies reporting the use of AI and machine learning for workforce management [12][13]. Platform-based staffing models have captured significant market share, with the medical gig economy platforms market expected to grow at 14.3% CAGR, reaching a projected market size exceeding $100 billion by 2030 [14][15].

The emergence of on-demand platforms represents a fundamental shift from traditional agency models toward direct-hire relationships that benefit both healthcare organizations and nursing professionals [16][17]. These platforms leverage mobile-first design, AI-powered matching algorithms, and real-time availability systems to achieve superior performance metrics compared to legacy staffing approaches [13][15].

Strategic Cost Hierarchy Analysis

Understanding the True Cost Structure

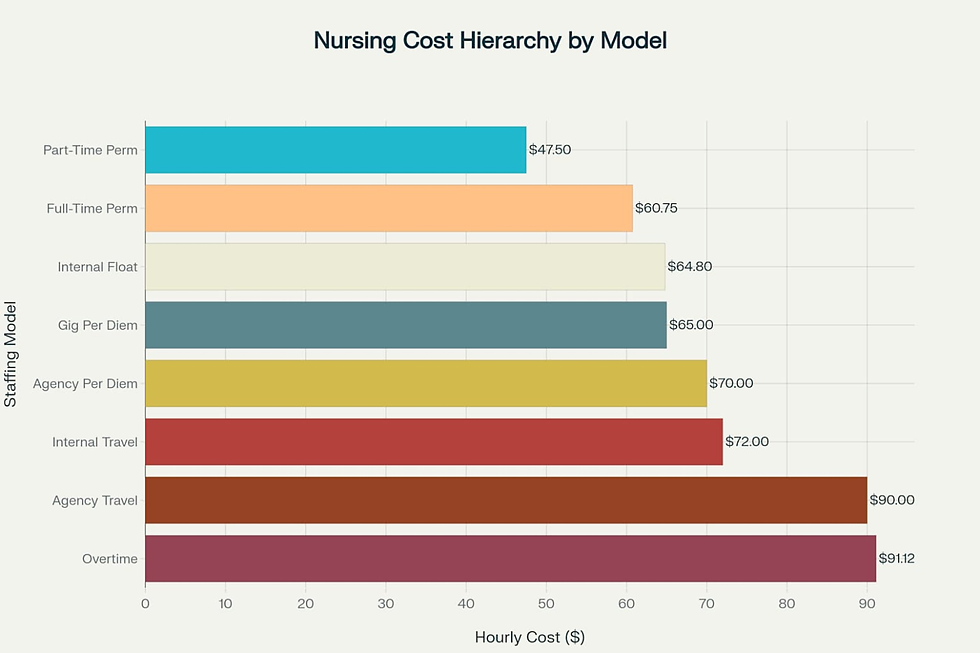

The acute care nursing staffing landscape demonstrates a clear cost hierarchy that healthcare leaders must understand to optimize their workforce strategies [5][18]. Permanent staff—both full-time and part-time—consistently emerge as the most cost-effective foundation, offering predictable expenses with long-term sustainability [5][19]. Internal solutions, including float pools, internal travel programs, and overtime, represent the mid-range cost tier, providing strategic flexibility while maintaining organizational integration [20][21].

Gig per diem platforms occupy the mid-high cost position, offering maximum flexibility while eliminating traditional agency markups [16][17]. Agency per diem models rank in the higher cost category due to intermediary fees and administrative overhead. In contrast, agency travel nursing consistently represents the most expensive staffing option due to housing stipends, travel reimbursements, and substantial agency markups [7][19].

The Economic Impact of Strategic Planning

The cost differential across this hierarchy creates substantial opportunities for strategic optimization through thoughtful workforce composition [5][18]. Healthcare systems that maintain strong permanent foundations while strategically deploying internal flexible resources can achieve significant cost advantages compared to organizations heavily reliant on external agency models [5][21]. Each percent change in registered nurse turnover can cost or save the average hospital $289,000 annually, underscoring the critical importance of retention strategies and sustainable staffing models [10][11].

Technology Revolution and Platform Adoption

Accelerating Digital Transformation

The healthcare gig economy is experiencing unprecedented growth, with adoption rates accelerating from current levels toward projected mainstream acceptance by 2030 [12][14]. This transformation reflects fundamental shifts in workforce preferences, with healthcare professionals increasingly prioritizing work-life balance, schedule autonomy, and flexible employment arrangements [22][17].

Healthcare organizations increasingly demand robust data transparency and analytics capabilities from workforce management solutions [13][15]. Modern platforms deliver real-time visibility into staffing needs, automated matching capabilities, and direct relationships between facilities and nurses that deliver superior cost and quality outcomes compared to legacy agency models [23][15].

Platform Technology Advantages

AI-powered platforms excel in predictive analytics, automated candidate matching, real-time data processing, and mobile-first design that appeals to modern healthcare professionals [13][15]. These systems enable dynamic pricing models, candidate no-show risk prediction, and demand forecasting, which render traditional fixed pricing approaches obsolete [22][15]. Healthcare workforce management is evolving toward technology-dependent care teams, where AI manages over 85% of customer interactions, reducing the need for human intervention and allowing healthcare professionals to focus on patient care [23][15].

Strategic Workforce Architecture Framework

Flexibility vs Cost Trade-offs

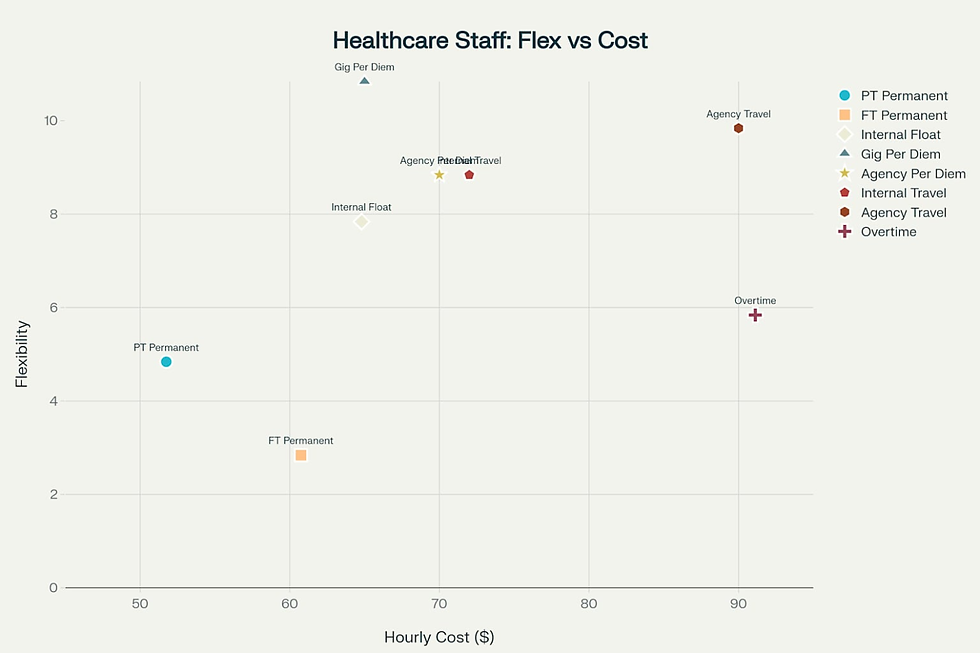

Healthcare organizations must navigate complex trade-offs between workforce flexibility, integration, and cost when selecting staffing models for acute care settings [5][20]. The relationship between operational flexibility and cost reveals important strategic considerations for workforce planning, with permanent models offering lower flexibility but superior cost efficiency and integration capabilities [5][21].

The analysis demonstrates that maximum flexibility does not necessarily correlate with maximum cost. Gig per diem models achieve the highest flexibility score (10/10) at $65.00 per hour, while agency travel commands $90.00 per hour for comparable flexibility (9/10). This finding suggests that technology-enabled platforms can deliver superior operational agility at more competitive rates than traditional agency models. Permanent staffing models anchor the low-flexibility, high-integration end of the spectrum, with part-time permanent staff offering moderate flexibility (4/10) at the lowest cost ($51.75/hour) and full-time permanent staff providing minimal flexibility (2/10) at $60.75 per hour. These models demonstrate maximum integration scores (10/10) due to their institutional knowledge and cultural alignment with organizational goals.

Strategic workforce planning requires sophisticated integration of multiple staffing models, each serving specific strategic purposes [6][20]. Permanent staff provides operational foundation and institutional knowledge, internal float pools offer planned flexibility, and technology-enabled platforms deliver surge capacity and specialized skills as needed [5][20]. The key to successful integration lies in maintaining appropriate ratios between permanent and flexible capacity while preserving organizational culture and patient care standards [5][21].

Long-term vs Reactive Approaches

The most successful healthcare organizations are transitioning from reactive hiring to strategic workforce architecture that optimizes combinations of permanent staff, internal float pools, and carefully integrated flexible capacity [8][6]. This approach requires sophisticated planning that considers patient acuity patterns, seasonal variations, and growth projections rather than simply filling immediate gaps [24][20].

Permanent staff models support career development pathways that attract and retain top nursing talent, creating sustainable recruitment advantages [5][25]. Organizations that demonstrate a commitment to permanent workforce investment position themselves as employers of choice in competitive labor markets, thereby reducing their dependency on expensive external staffing sources [5][25].

Market Projections and Future Outlook

Escalating Workforce Pressures

Market projections indicate sustained pressure on healthcare staffing through 2030, with nursing shortages expected to intensify alongside rising replacement costs [1][2]. The compound effect of increasing workforce gaps and escalating turnover expenses creates mounting financial pressure on healthcare organizations to develop more sustainable staffing strategies [10][11].

The healthcare staffing market exhibits robust growth momentum, with projections indicating continued expansion driven by aging populations and rising demand for healthcare services [26][24]. However, the traditional reliance on expensive external staffing solutions becomes increasingly unsustainable as costs continue to escalate while workforce availability declines [10][7].

Industry Consolidation Trends

Healthcare industry consolidation continues to reshape staffing strategies, with organizations pursuing strategic mergers that focus on technology integration and workforce optimization, rather than simply expanding their scale [27][28]. This trend supports the adoption of unified staffing platforms and coordinated workforce management across integrated delivery networks [29][30].

The emergence of direct-sourcing strategies and technology-enabled platforms challenges traditional intermediary models that add cost without proportional value [27][19]. Healthcare systems are increasingly abandoning complex managed service provider arrangements in favor of vendor-neutral approaches that provide greater control over workforce strategy and cost management [31][19].

Implementation Framework and Best Practices

Optimal Staffing Mix Strategy

The evidence strongly supports a balanced approach that combines high-integration permanent staff with strategically deployed flexible resources to create resilient, cost-effective staffing ecosystems [5][21]. Organizations should maintain strong permanent cores for stability and institutional knowledge while utilizing internal float pools and technology-enabled platforms for planned and surge capacity [20][21].

Healthcare systems can optimize their staffing investments by maintaining a 60-70% permanent staff, supplemented strategically with internal solutions and cost-effective, flexible models [5][24]. This balanced approach minimizes over-reliance on expensive agency models while maintaining operational flexibility to respond to census fluctuations and unexpected demand [8][20].

Quality and Financial Risk Management

Excessive reliance on high-cost, low-integration models creates both financial and clinical risks that extend beyond direct wage costs [10][32]. Research demonstrates that high turnover rates correlate with increased medical errors, patient falls, and other adverse events that generate significant indirect costs [33][32]. Organizations must balance cost control with quality maintenance through diversified workforce portfolios that minimize dependency on any single high-cost model [5][32].

Long-term financial sustainability requires balancing immediate staffing needs with quality outcomes and staff retention to minimize the compounding costs of turnover and expensive agency staffing [10][33]. Strategic workforce planning that anticipates demand patterns and invests in retention can significantly reduce reliance on the highest-cost staffing models while maintaining operational excellence [5][25].

Minimization of Legacy Models

The Decline of Traditional Agency Dependence

Healthcare systems are moving away from traditional agency-heavy models as cost pressures intensify and more sustainable alternatives emerge [27][19]. The financial impact of over-reliance on agency models extends far beyond hourly rates, with each nurse turnover costing healthcare facilities an average of over $61,000. In contrast, agency relationships often lack the institutional knowledge necessary for optimal patient outcomes [10][19].

Agency models require additional onboarding investment, reduce team cohesion, and create operational inefficiencies that compound direct cost burdens [32][18]. The productivity impact of constantly rotating staff makes agency-heavy models unsustainable for long-term financial health [33][32].

Industry Consolidation and MSP Evolution

Traditional managed service provider (MSP) models are facing increasing pressure as healthcare organizations seek greater control over workforce strategy and cost management. MSP market share is projected to decline from current levels as organizations adopt vendor-neutral approaches that provide better visibility and cost efficiency. The emergence of direct-sourcing strategies and technology-enabled platforms challenges traditional intermediary models that add cost without proportional value.

Healthcare industry consolidation continues to reshape staffing strategies, with organizations pursuing strategic mergers that focus on technology integration and workforce optimization, rather than simply expanding their scale. This trend supports the adoption of unified staffing platforms and coordinated workforce management across integrated delivery networks.

Strategic Transition Planning

Healthcare organizations are implementing phased transition strategies beginning with pilot deployments in high-volume units to document cost savings and efficiency gains [8][25]. Performance validation during pilot phases provides essential evidence for enterprise-wide expansion and stakeholder buy-in [6][20].

Organizations must assess current agency contract terms and identify opportunities for strategic disengagement while building direct relationships with high-performing staffing providers [19][18]. The transition requires cross-functional teams, including HR analysts, operations managers, clinical leaders, and IT specialists, to ensure successful platform integration and change management [25][6].

The Path Forward

The acute care nursing workforce is entering a new era characterized by strategic sophistication rather than reactive crisis management [8][6]. Healthcare organizations that embrace this transformation—building strong permanent foundations while thoughtfully integrating modern flexible capacity—will achieve sustainable competitive advantages in cost, quality, and operational resilience [5][24].

Success in this new landscape requires leadership commitment to long-term workforce investment, sophisticated planning capabilities, and strategic vision to move beyond reactive hiring toward comprehensive workforce architecture [8][25]. The organizations that make this transition now will establish enduring competitive advantages in an increasingly challenging healthcare environment, positioning themselves for sustainable growth and superior patient outcomes [5][6].

The future belongs to healthcare systems that recognize staffing as a strategic capability rather than an operational necessity, leveraging technology and data-driven insights to build resilient workforce ecosystems that adapt to changing market conditions while maintaining unwavering focus on patient care excellence [24][6].

11. https://plexsum.com/2025/04/08/the-real-cost-of-nurse-turnover-what-hospitals-need-to-know-in-2025/

15. https://clinicalresources.com/innovations-in-healthcare-staffing-technology-trends/?no_redirect=true

22. https://burnettspecialists.com/blog/gig-economy-trends-for-2025-what-job-seekers-and-employers-need-to-know/

26. https://www.businesswire.com/news/home/20220128005258/en/Global-Healthcare-Staffing-Market-Trajectory-Analytics-Report-2022-Amid-the-COVID-19-Crisis-the-Market-is-Set-to-Grow-from-$33.8-Billion-in-2020-to-$47.8-Billion-by-2026---ResearchAndMarkets.com

29. https://www.baldwincpas.com/insights/practice-consolidation-heats-up-in-2025-what-you-need-to-know

Comments